What properties qualify?

The following types of properties qualify for our Homeownership Program:

- Single-Family - Detached

- Single-Family - Attached

- Condominiums

- Townhomes

Escambia County Housing Finance Authority (ECHFA) helps homebuyers achieve their homeownership dream, which typically translates to Lenders seeing an increase in loan closings.

We periodically launch new programs, so please be sure to revisit and bookmark our website as a resource when researching attractive Homeownership Programs for your clients.

For more information on what properties qualify, and participating counties, scroll below.

| FEATURE | BENEFIT |

|---|---|

| 30-year Fixed Rate Mortgage Loan with an ECHFA DPA Program option for Down Payment and Closing Cost Assistance. See "Today's Interest Rates." | Don’t wait. An affordable interest rate means lower monthly mortgage payments. Keep your money for that all important emergency fund. |

| Discount/Origination Fee | The combined total discount fees may not exceed 1.00% of the principal loan amount. |

| Documentary Stamp Tax and Intangible Tax | The Authority's first Governmental Loan Option mortgage loan is EXEMPT from Florida Documentary Stamp Tax. |

| Recapture Tax | The Authority's Governmental Loan Option mortgage loans are NOT subject to Recapture Tax. |

| FEATURE | BENEFIT |

|---|---|

| 30-year Fixed Rate Mortgage Loan with an ECHFA DPA Program option for down payment and closing cost assistance. See "Today's Interest Rates." | The Freddie Mac HFA Advantage (Conventional Option) Program significantly lowers the cost of Mortgage Insurance over the term of the loan. |

| Origination Fee | The origination fee may not exceed 1.00% of the principal loan amount. |

| Homeownership Education | Buyers utilizing the Freddie Mac HFA Advantage (Conventional) Program Option will be required to complete an approved homebuyer education course and must provide a certificate of completion of the course prior to closing. |

| FEATURE | BENEFIT |

|---|---|

| 30-Year Deferred Non-Interest Bearing Second Mortgage Loan up to $10,000*. | Unlike most Second Mortgages, there are NO monthly payments on our down payment and closing cost assistance loans. |

| Interest on Second Mortgage | The 30-Year Deferred Second Mortgage is non-interest bearing, therefore no interest will accrue. |

| Term of Second Mortgage | The 30-Year Deferred Second Mortgage is fully payable when the first mortgage is due upon sale, refinance, transfer of title or simply paying off the first mortgage. |

| FEATURE | BENEFIT |

|---|---|

| Mortgage Credit Certificate Program | Mortgage credit certificates should be available for qualifying homebuyers in connection with the AUthority's TBA Mortgage Loan Program by the end of the year. |

| What is a Mortgage Credit Certificate? | A Federal Tax Credit available each year that the borrower continues to live in the home financed under the Program. |

| Homeownership Education Certificate | Each homebuyer must agree to participate in a Homebuyer Education Class approved by the Authority prior to being eligible to receive a mortgage credit certificate. |

| FEATURE | BENEFIT |

|---|---|

| Fixed Rate | The Authority's fixed rate loans do not have surprise payment increases, allowing you to better budget your income. |

| 30-Year Loan Term | Keep monthly mortgage payments low since they are spread across 360 months. |

| First-Time Homebuyers or Former Homeowners | Qualifying Homebuyers have not owned a home in the last three years. |

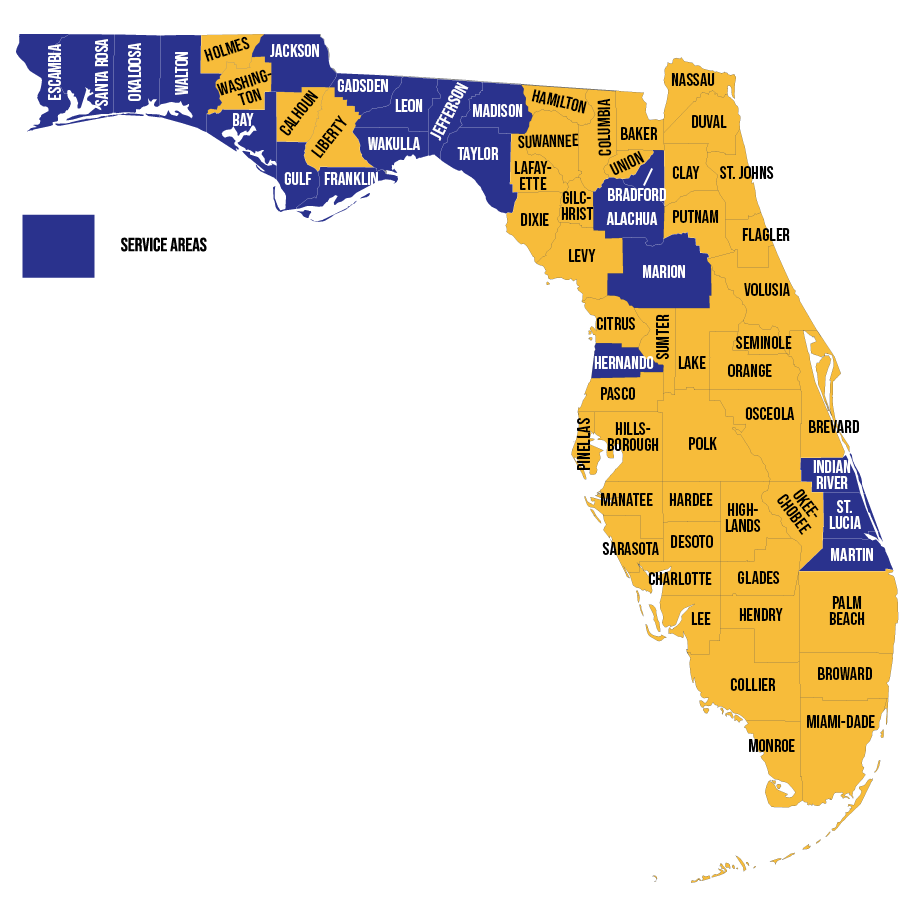

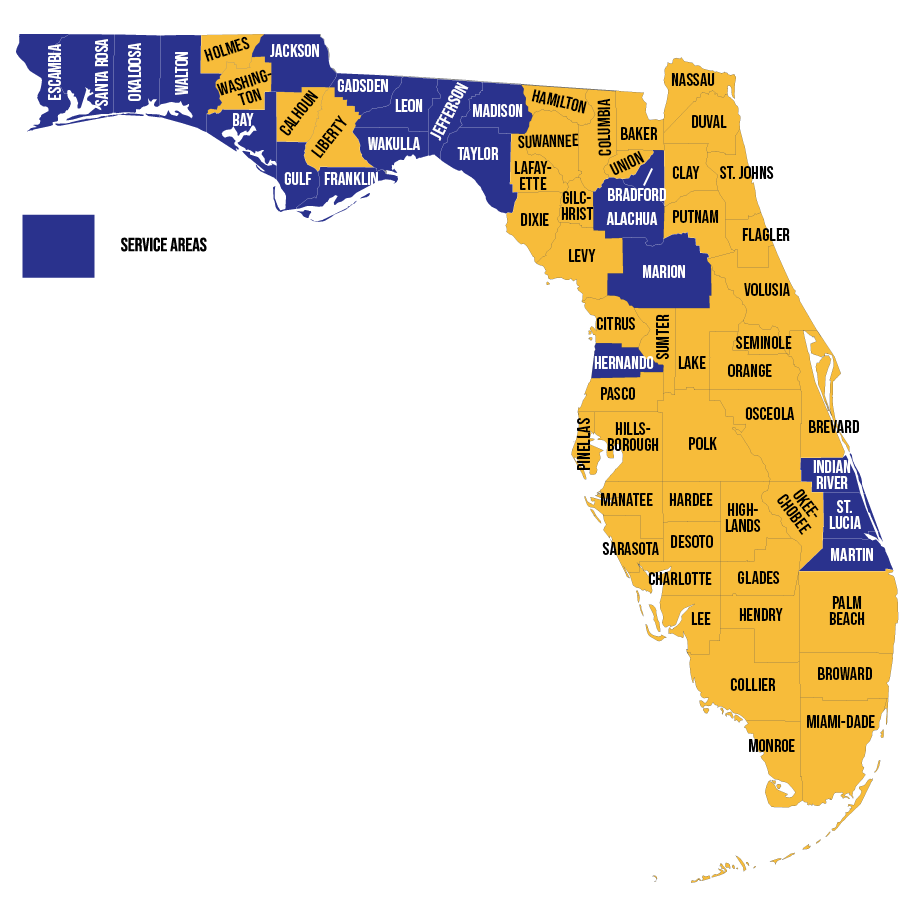

| Multi-County | Don’t be fooled by our name. We don’t just serve Escambia County. We currently serve 21 Counties across Florida. |

| Military Veteran Support | As a ‘thank you’ to our veterans, the first-time homebuyer requirement is waived for honorably discharged military veterans as defined in 38 U.S.C. 101. |

| Non-First Time Homebuyer | Select a home in a designated Targeted Area and the first time homebuyer requirement is waived. |

*All program FEATURES are subject to change. Second Mortgage funds only to be used towards down payment and/or closing costs. Participating Lenders provide specific APR information as required by law.

7.00

7.50

The following types of properties qualify for our Homeownership Program:

Participating Florida Counties

Alachua, Bay, Bradford, Escambia, Franklin, Gadsden, Gulf, Hernando, Indian River, Jackson, Jefferson, Leon, Madison, Marion, Martin, Okaloosa, Santa Rosa, St. Lucie, Taylor, Wakulla, Walton (or see our) Targeted Areas.

The total purchase price of a property may not exceed the Purchase Price Limits listed on the corresponding Participating County Page.